llc s corp tax calculator

Estimate your corporations taxes with Form 1120 or using. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS.

Use This S Corporation Tax Calculator To Estimate Taxes

Annual state LLC S-Corp registration fees.

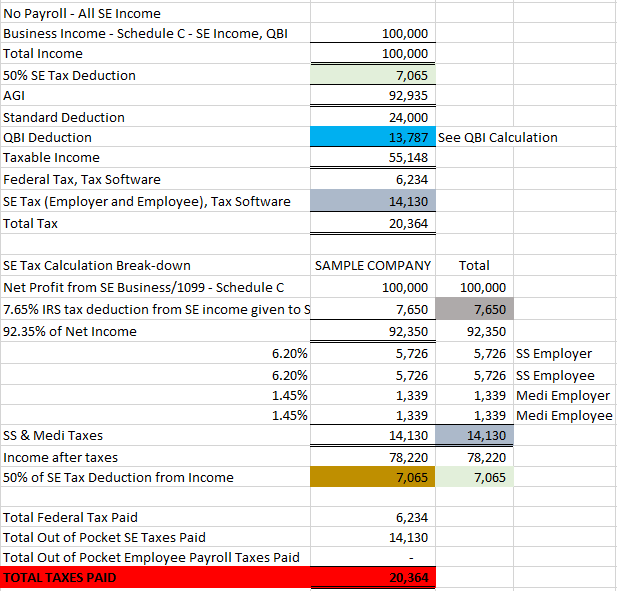

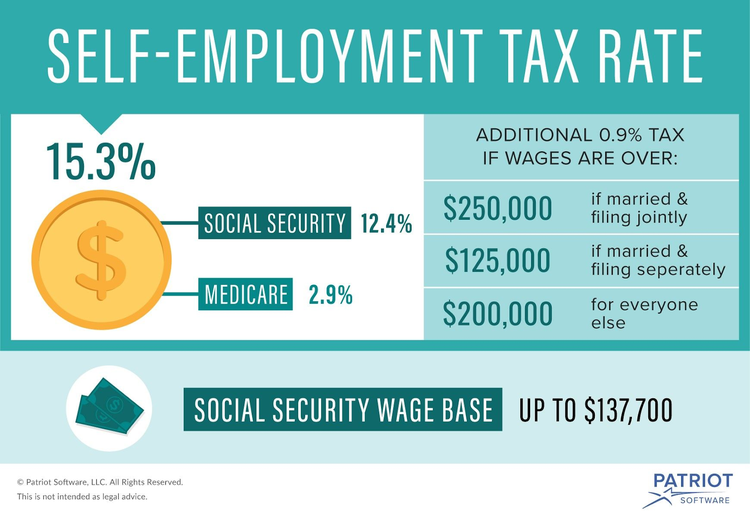

. Additional Self-Employment Tax Federal Level 153 on all business income. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770.

For example if you have a. When you form an LLC you have the option of electing to be taxed by default or as an S corp or C corpThis flexibility can be helpful in managing your overall tax. This tax calculator shows these values at the top of.

Dividing revenue in this way can enable S corporations to lower their tax burden and put more of their money back into the enterprise. Keep in mind that this is an estimate and you should always have your LLCs taxes filed or at least reviewed by a certified tax preparer. Taxes vary depending on the business entity.

Estimated Local Business tax. Corporations use the LLC tax rate calculator to determine taxes. You can use an S corporation tax calculator.

Taxes are determined based on the company structure. How S Corporations Help Save Money. Get the spreadsheet template HERE.

Many of our clients choose the latter for several reasons. Calculating Your LLC Tax Savings is as Easy as 1-2-3. The s corp tax calculator.

This application calculates the. Just complete the fields below with your best estimates and then register to get your CPA or schedule a free Consultation here 1 Select. The LLC tax rate calculator is used by corporations to calculate their taxes.

Total first year cost of S-Corp administration. Our calculator also doesnt take into. This additional tax covers Social Security Medicare taxes that would normally be paid on your W2 income S.

Shares of certain types of corporations are eligible for a potentially significant tax exemption ie 10 million or 10x the initial investment are taken tax-free. Form 1120 or the taxable income of last year. Annual cost of administering a payroll.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. The s corporation tax calculator lets you choose how much to withdraw from your business each year and how. This offers you an estimate for your business net income for the year to use in our S Corp tax savings calculator.

All profit from a sale is taxed at. Overall the LLC business structure offers more flexibility than an S Corp but an S Corp can save you money on self-employment taxes. But as an S corporation you would only owe self-employment tax on the 60000 in.

If you want to take advantage of these tax rules you can either form an s corporation or form an llc.

Small Business Tax Calculator Taxfyle

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How To Save On Taxes By Electing To Be Taxed As An S Corp Houston Tx Certified Public Accountant Accounting Tax Financial Services Quickbooks Huda Cpa Firm Pllc

How To Calculate Your Business Tax Liability

Navigating Taxes For Llcs Top Tips To Ease The Headache

:max_bytes(150000):strip_icc()/changing-your-llc-tax-status-to-a-corporation-or-s-corp-398989-FINAL-edit-a7c328f6cc494d9d9e60f964181583e4.jpg)

How To Change Your Llc Tax Status To A Corporation Or S Corporation

Should You Choose S Corp Tax Status For Your Llc Smartasset

Optimal Choice Of Entity For The Qbi Deduction

Converting From C To S Corp May Be Costlier Than You Think

At Tax Time How To Weigh The Benefits Of A C Corp Vs An S Corp Vs An Llc Vs A Sole Proprietorship Inc Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Use This S Corporation Tax Calculator To Estimate Taxes

Calculating Additional Tax On The Sale Of S Corp Stock Windes

Use This S Corporation Tax Calculator To Estimate Taxes

Should You Choose S Corp Tax Status For Your Llc Smartasset

S Corp Vs Llc Difference Between Llc And S Corp Truic

Llc Vs S Corp Which One Is Best For Small Business Owners Create Cultivate