how much is virginia inheritance tax

How much can you inherit without paying taxes in virginia. To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax.

The tax shall be an amount computed by multiplying the federal credit by a fraction the numerator of which is the value of that part of the gross estate over which Virginia has jurisdiction for.

. Rates and tax laws can change from one year to the next. For example Indiana once had an inheritance tax but. The top estate tax rate.

Virginia estate tax. Your estate is worth 500000 and your tax-free threshold is 325000. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. 1 hour agoBy Lauren Almeida 4 November 2022 930pm.

Your average tax rate is 1198 and your marginal tax rate is 22. Virginia Inheritance and Gift Tax. How Much Is the Inheritance Tax.

How much can you inherit without paying taxes in 2020. The estate can pay Inheritance. The top estate tax rate is 16 percent exemption threshold.

Pennsylvania does charge an inheritance and estate tax in some cases. No estate tax or inheritance tax Arkansas. Again this effectively means there is no federal gift tax imposed on the majority of Americans.

Heres a breakdown of each states inheritance tax rate ranges. The tax rate varies. A further raid on pension savings will mean two million savers now face tax charges of up to 55pc on their retirement funds analysis.

How much can you inherit without paying taxes in 2020. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

No estate tax or inheritance tax California. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

States may also have their own estate tax. No estate tax or inheritance tax Arizona. This is great news for Virginia residents.

No estate tax or inheritance tax Alaska. This marginal tax rate means. Currently each individual may exempt from the gift tax up to 14000000 of gifts.

How much is virginia inheritance tax. The estate tax rate is 40. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Estate Taxes Virginia Wills Trusts Estates

State Estate And Inheritance Taxes Itep

Virginia State Tax Resolution Options For Back Income Taxes

Inheritance Law In Virginia Jdkatz P C

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Virginia Income Tax Calculator Smartasset

Cotton Boozman Blunt And Ernst Introduce Estate Tax Rate Reduction

Analyst Northern Virginia Suburbs Likely Immune From Dropping Home Prices News Arlington Insidenova Com

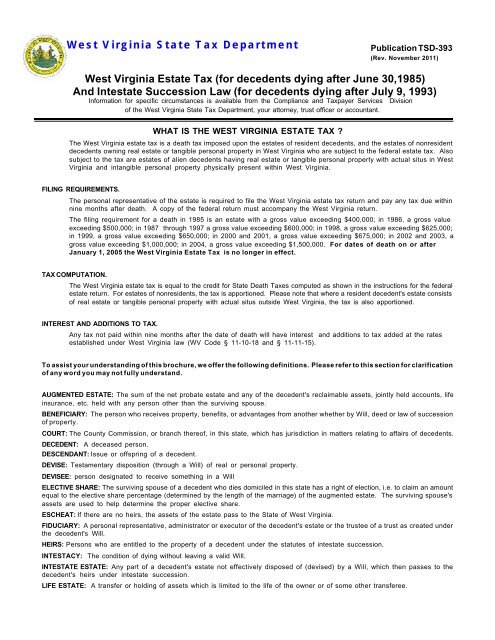

What Is The West Virginia Estate Tax Publication Tsd 393

Estate Advice Northern Virginia 2021 Outlook For Gift And Estate Taxes

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax Planning In Virginia The Nance Law Firm

By John P Dedon 1775 Wiehle Avenue Suite 400 Reston Virginia 703 Vada Family Convention Greenbrier Financial Ppt Download

State Estate And Inheritance Taxes Itep

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

3 Taxes That Can Affect Your Inheritance

Bill To Cut Inheritance Tax Rates Increase Exemptions Advanced Unicameral Update

Estate Tax Calculator Washington Dc Maryland Virginia Lawyer Attorney Law Firm